Stock Trading

Trade the World's Leading Companies

Gain exposure to the performance of major global corporations through stock CFD trading. With NavionFX, you can capitalize on the share price movements of leading companies from around the world, whether prices are rising or falling.

What is Stock Trading?

Stock trading allows you to speculate on the price movements of company shares without actually owning the underlying stocks. When you trade stock CFDs with NavionFX, you can profit from both rising and falling stock prices by going long (buy) or short (sell).

Stocks market spreads and swaps

The most traded compaies in the forex market:

Symbol

Avg. spread

pips

Commission

per lot/side

Margin

1:2000

Long swap

pips

Short swap

pips

Stop level

pips

Big Tech Giants

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Financial Sector

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Healthcare & Pharmaceuticals

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Other

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

The most traded compaies in the forex market:

Symbol

Avg. spread

pips

Commission

per lot/side

Margin

1:2000

Long swap

pips

Short swap

pips

Stop level

pips

Big Tech Giants

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Financial Sector

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Healthcare & Pharmaceuticals

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Other

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

The most traded compaies in the forex market:

Symbol

Avg. spread

pips

Commission

per lot/side

Margin

1:2000

Long swap

pips

Short swap

pips

Stop level

pips

Big Tech Giants

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Financial Sector

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Healthcare & Pharmaceuticals

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Other

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

The most traded compaies in the forex market:

Symbol

Avg. spread

pips

Commission

per lot/side

Margin

1:2000

Long swap

pips

Short swap

pips

Stop level

pips

Big Tech Giants

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Financial Sector

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Healthcare & Pharmaceuticals

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

Other

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

AUDUSDm

Australian Dollar vs US Dollar

0.9

$0

0.05%

−0.18

0

0

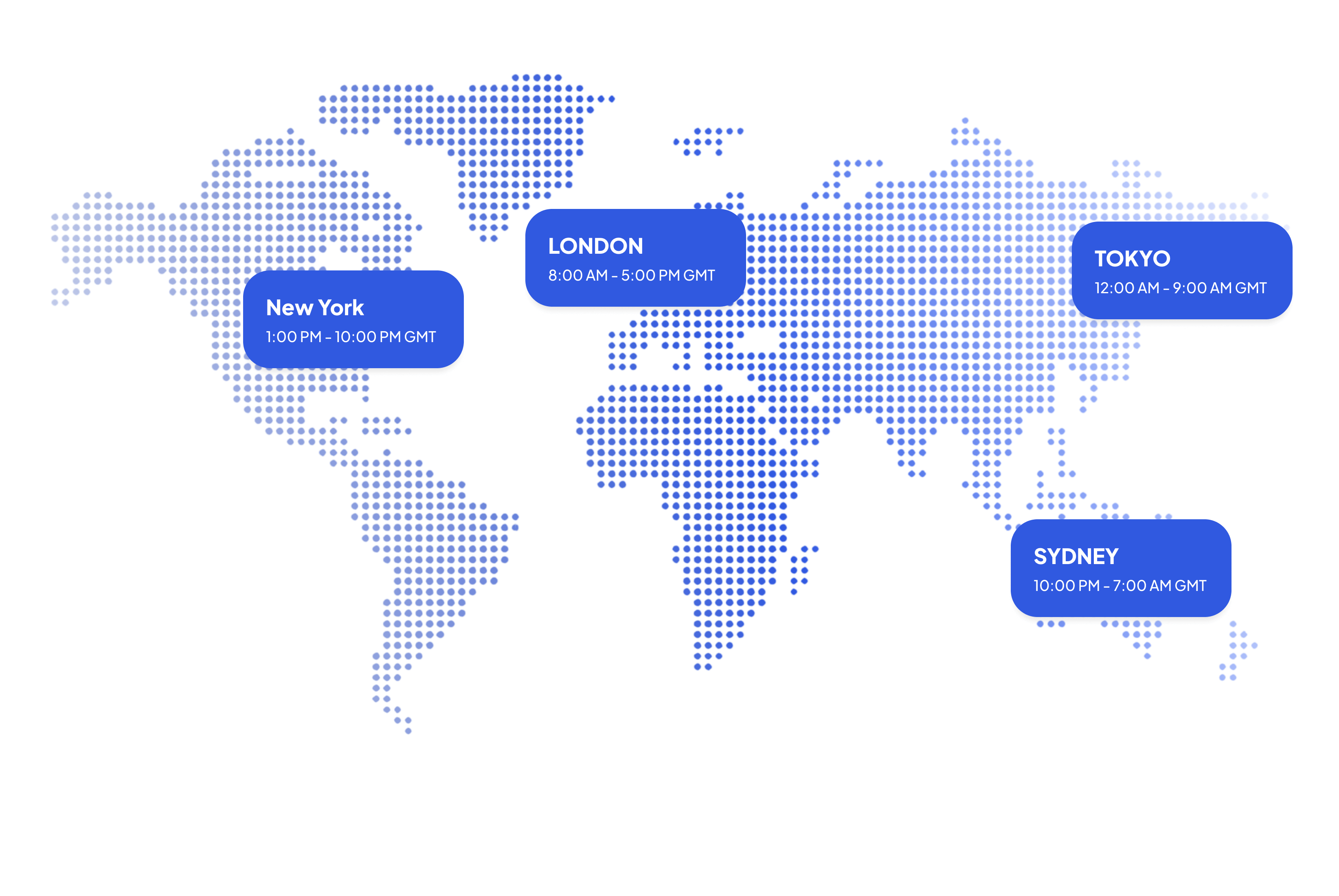

Trading Hours

All stocks are available for trading 24/7, providing continuous access to global equity markets.

Why Traders Choose Us

Trade shares of top global companies with greater flexibility, control, and simplicity. Access advanced tools, short-selling options, and leveraged exposure all from a single platform.

Access Global Markets

Trade shares of major companies from around the world through a single platform, without the need to open multiple accounts with different brokers.

Go Long or Short

Profit from rising and falling stock prices by short-selling, enabling you to take advantage of market downturns while maintaining control over your positions.

Leverage Your Capital

Use leverage to open larger positions with a smaller investment, allowing you to amplify potential returns while managing your overall exposure.

Trade Your Way

Discover popular trading strategies used by stock traders across different timeframes. Whether you’re active or hands-off, choose the style that fits your goals and market outlook.

Day Trading

Buy and sell stocks within the same day

Capitalize on short-term price movements

Needs active tracking and quick decisions

Ideal for volatile, highly liquid stocks

Swing Trading

Hold positions for several days to weeks

Target mid-term market trends or reversals

Requires less screen time than day trading

Uses technical analysis and chart signals

News Tracking

Trade on earnings and company updates

Profit from market reactions to new events

Needs speed, discipline, and risk control

Track economic events and key data releases

Smart Risk Management

Effective risk management helps protect your capital during volatile market conditions. Use these core principles to manage exposure and make more disciplined trading decisions.

Position Sizing

Risk 2-3% of capital on every single trade

Size trades based on stop-loss distance

Factor in volatility

Stop-Loss Orders

Set exits to limit your downside potential

Use key levels for precise stop placement

Protect gains with trailing stop strategy

Diversification

Don't concentrate in a single sector

Spread risk across key market sectors

Reduce risk with asset diversification

What Moves the Market

Earnings Season

Quarterly earnings reports often lead to sharp stock moves, especially when results differ from expectations. Traders watch these closely for gaps, volatility, and short-term opportunities.

Economic Indicators

GDP, interest rates, and employment data shape market sentiment and sector performance. These events often trigger broad market reactions and impact investor confidence.

Company-Specific News Stops

New product launches, leadership changes, or mergers can

move individual stocks significantly. These updates signal

shifts in company outlook and attract fast market

response.

Getting Started with Stocks Trading

Get Started Now

Start with Demo

Start risk-free with $10,000 virtual funds and real market conditions.

Build Knowledge and Strategy

Learn about companies, market dynamics, and define a trading approach that suits your goals.

Open an Elite Account to Go Live

Ready to trade? Open an Elite account with a $10,000 deposit to start real trading.

Start Small, Then Optimize

Begin with small trades, monitor performance, and refine your strategy over time.

Ready to Trade Stocks?

Start your stock trading journey with our risk-free demo account, then access the global stockmarket through your NavionFX Elite account when ready.